does betterment provide tax documents

HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. Just lump them together under a country.

The foreign taxes populate with the download but you have to manually enter the foreign source income total.

. The workaround I did is to do the import from betterment using online version and save the online tax return to a file and open it using the desktop version as a new return and. We organize assets based on taxes. Any tax forms from Betterment that do not have a FATCA box can be.

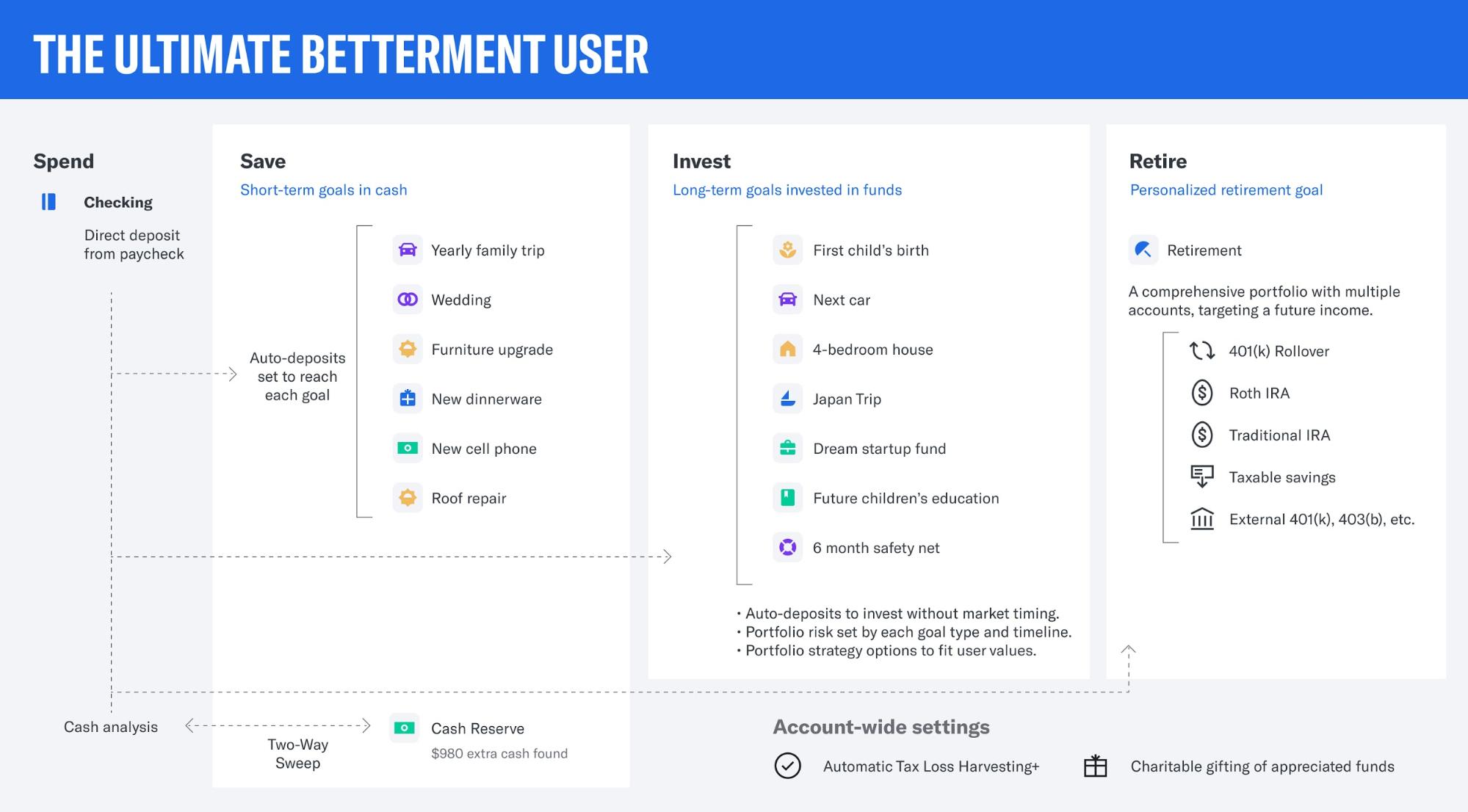

Exchange-traded funds are generally more tax-efficient and lower-cost than mutual funds which is why we have an all-ETF portfolio. The three Betterment fee tiers are all based on the balance in an investors portfolio. Should you need help Betterment Digital customers can pay 199 for a 45-minute coaching session with a financial professional to optimize their investments.

If you need your tax forms you can download them in. General repair or maintenance to sustain an assets current value is not considered. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals.

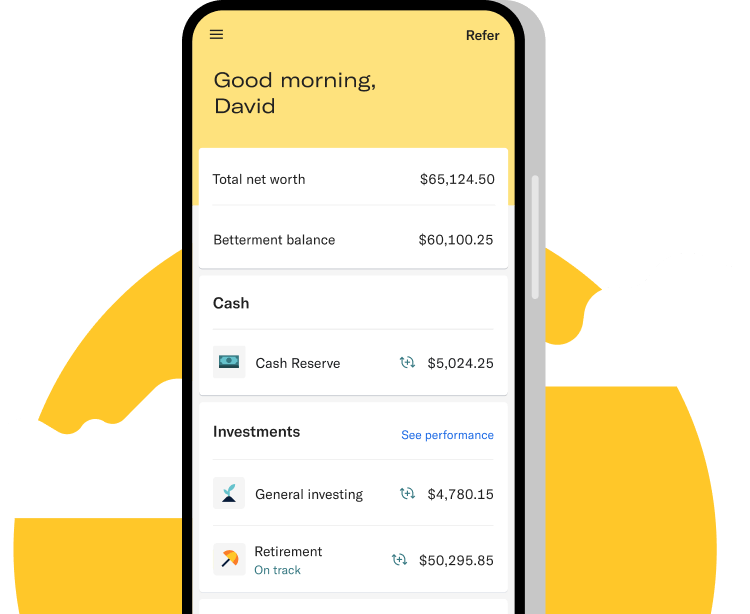

Betterment is one of the larger robo-investor sites which offers investors an alternative to more traditional human financial advisers. Betterment Digital provides automated portfolio management and charges 025 annually. 31 is the deadline for Betterment to provide Form 1099-R which reports distributions conversions and.

Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. The other is for broking services. As an active investor be aware that your category Box A sales without adjustments do not require.

Please note that Betterment is not a tax advisorplease consult a tax professional for additional guidance including help with the preparation and filing of tax returns. The no-fee plan costs 0 in fees and requires 0 in a minimum balance. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

Betterment has been a member of FINRA since 1999. Even with a Betterment Builder account which is an account with an investment balance of less than. Ad Offer your employees a better 401k for a fraction of the cost of most providers.

Forms 1099-R and 1099-INT released. Ad Offer your employees a better 401k for a fraction of the cost of most providers. HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund.

The number is 149117. Projects that qualify as improvements will depend on the taxing. 500 is in regular investment account.

With Betterment you can automatically import your tax information into HR Block. Simplified set-up and administration makes it easy to offer your employees a better 401k. Betterment has multiple pricing plans from fee-free plans to 04 annual fees.

Betterment Taxes Summary. Any sales where you make money will be a taxable event. From a web browser after logging in to your account go to Transfer or Rollover Withdraw Withdrawals generally take about 4-5 business days to process.

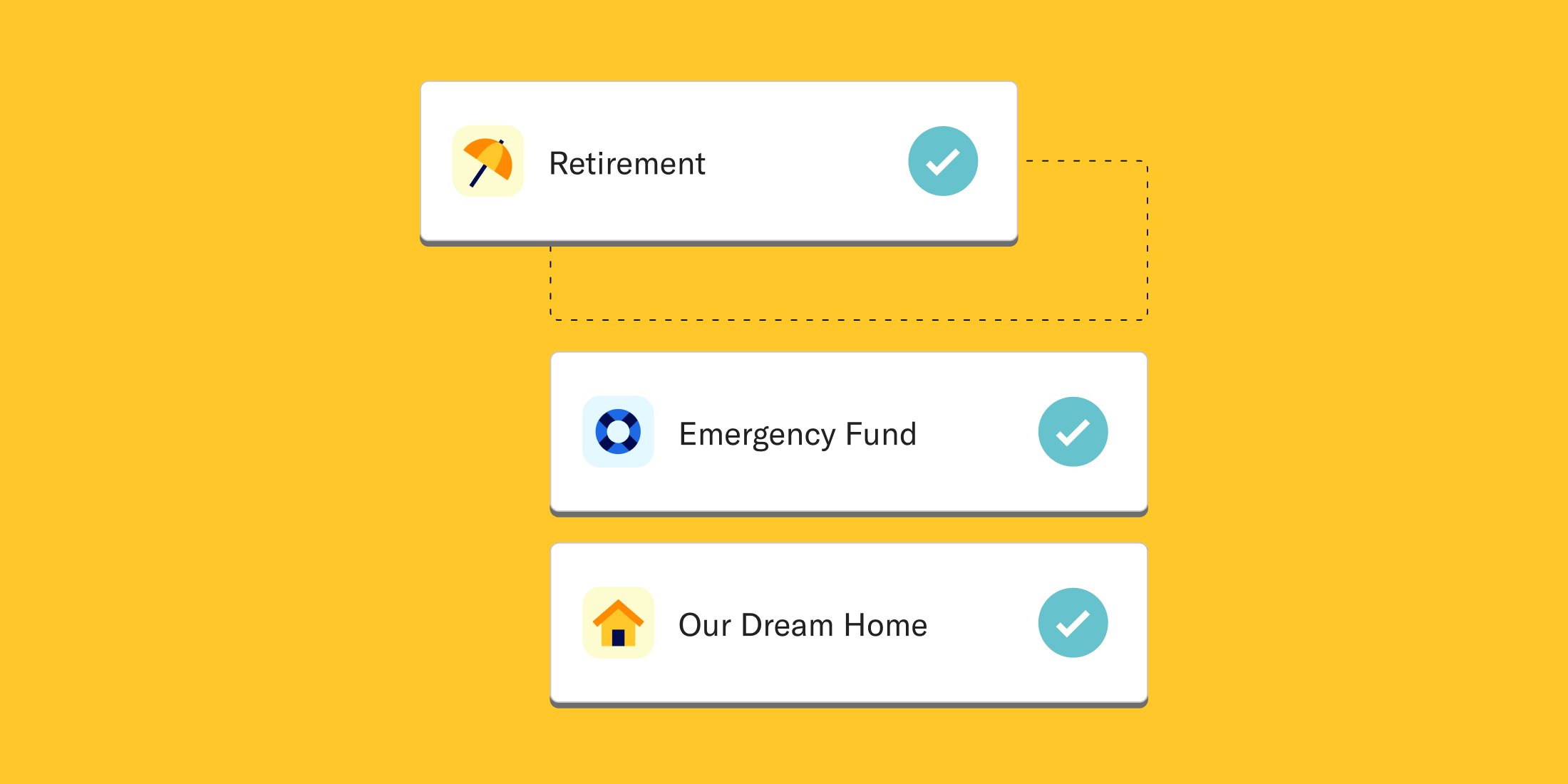

The soonest you can start importing is Feb. A Betterment tax coordinated portfolio automates the strategy of asset allocation and optimizes it by placing assets that will be highly taxed into qualified retirement accounts. Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually.

They are not intended to provide comprehensive tax advice or. Simplified set-up and administration makes it easy to offer your employees a better 401k. Betterment is a clear leader among robo-advisors offering two service options.

As one of the first financial groups to. On Betterments broker-dealer profile available. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts.

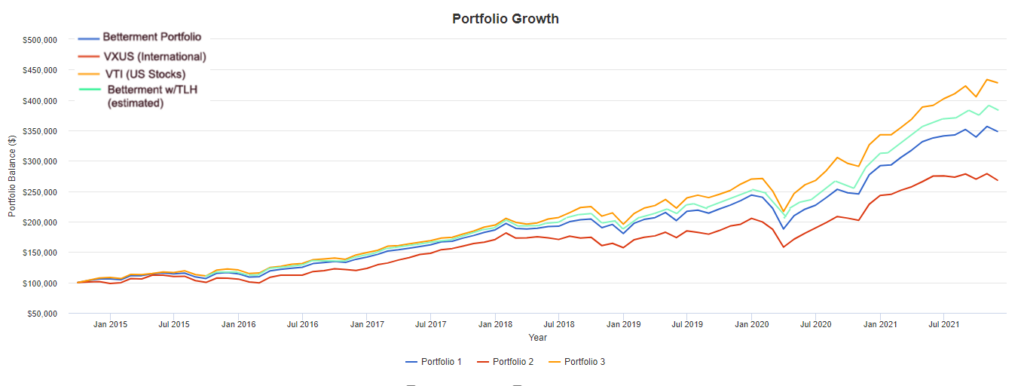

A betterment is a specific type of project performed by a government entity that improves a specific area. Betterment claims that investing in a Betterment portfolio since 2004 would have produced a cumulative return of 1906 which is an average annual return of 73This beats. Check your 1099-B transaction list to see how many wash sales you have.

Betterment is an expenditure that improves an assets performance or increases its value. In a nutshell you pay less in taxes by holding investments longer. Tax-loss harvesting has been shown to boost after.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket. Any dividends earned will. This is the only one that matters for tax purposes.

Tax Smart Investing With Betterment

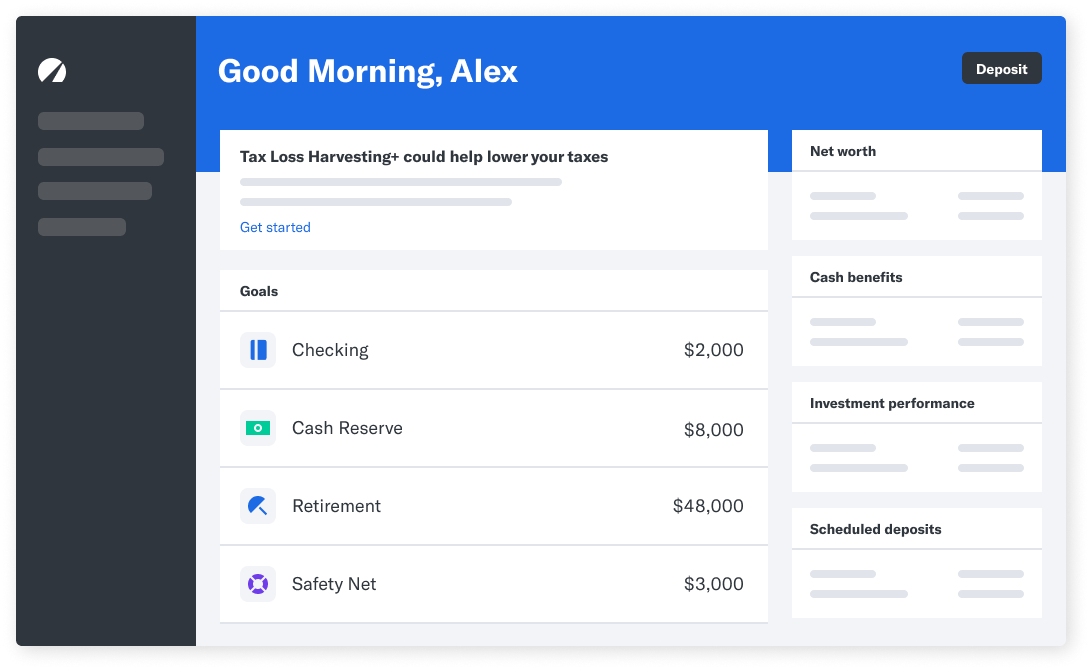

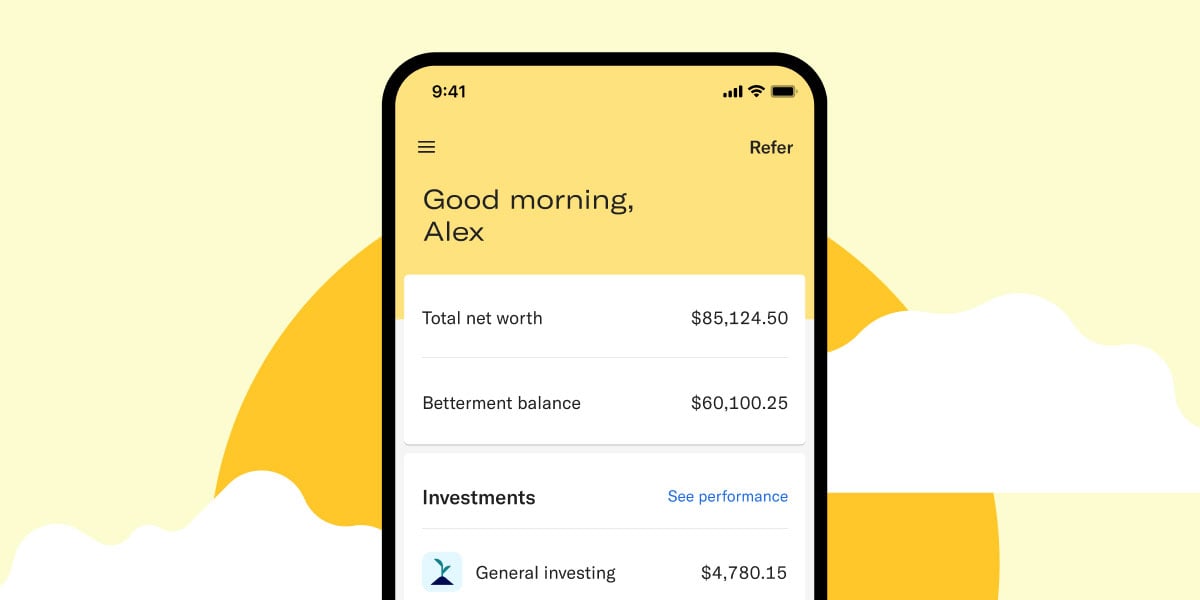

Betterment Mobile App Investing On The Go

Betterment Checking And Betterment Cash Reserve Review Cash Management Certificate Of Deposit Best Ira Accounts

Betterment Review How It Works Pros Cons

Betterment Review 2021 Is It Really A Smarter Way To Invest

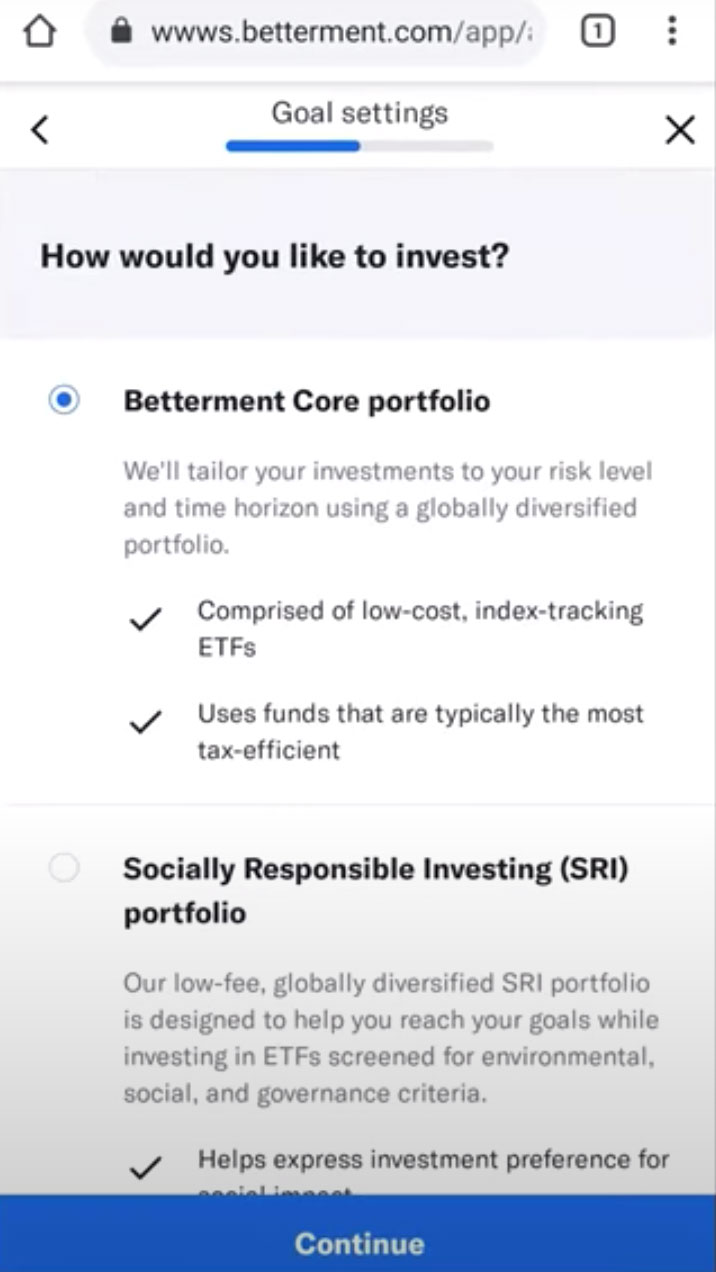

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Season Calendar Tax Season Tax

Betterment Updates Their Site To Give Better Advice Enhanced Reporting And Better Site Performance

Using Investment Goals At Betterment

The Betterment Experiment Results Mr Money Mustache

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Tax Smart Investing With Betterment

6 Tax Strategies That Will Have You Planning Ahead

/betterment_inv-f807c64202ac48a9a5a7dcfe4f2e6205.png)